Disney shareholders accused the media giant’s leadership of misleading investors with “a fraudulent scheme designed to hide the extent of Disney+ losses,” according to a new lawsuit.

The complaint, filed by New Jersey-based Stourbridge Investments on Aug. 23 in Delaware federal court, claims Disney management under then-CEO Bob Chapek tried to conceal the “staggering costs” it incurred while attempting to boost its subscriber count and promise profitability by the end of 2024.

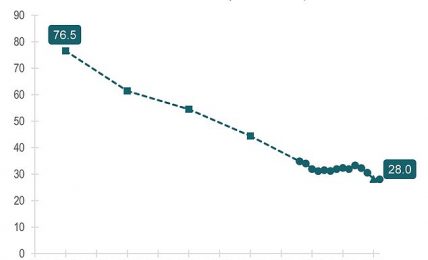

The suit was lodged the day before Disney shares closed at a nine-year low of $82.47 per share — far below the $100 the stock traded at after Bob Iger replaced the ousted Chapek last November.

The stock was at $84.16 in midday trading on Wednesday.

Investors claimed they were deliberately duped by statements from Chapek — specifically one from December 2020 — which boasted that “Disney+ has exceeded our wildest expectations” and “bolstered our confidence” despite suspicious profitability forecasts.

The suit also cites a “hugely controversial” reorganization of the company’s media and entertainment operations that allowed Chapek to exert “near complete control over the company’s strategic decisions around content.”

According to The Hollywood Reporter, the Mouse House faces an identical investor suit over an alleged “cost-shifting scheme” in its streaming division and claims that it obstructed a deal between TSG Entertainment Finance and 20th Century Studios, which Disney owns, to “prop up” Disney+ and juice its stock price.

In the Stourbridge Investments suit, the plaintiff not only named Chapek, who ran the Disney from 2020 to 2022, in the lawsuit, but also Iger, along with former chief financial officer Christine McCarthy and ex-Media & Entertainment Distribution chairman Kareem Daniels.

“To conceal these adverse facts, defendants engaged in a fraudulent scheme designed to hide the extent of Disney+ losses and to make the growth trajectory of Disney+ subscribers appear sustainable and 2024 Disney+ targets appear achievable when they were not,” the shareholder said.

The suit claims that after Disney acknowledged that subscriber growth had slowed in 2021.

Last year, the company reported that it missed analyst estimates by wide margins on revenue, sales and earnings.

“The company also reported a decline in its average revenue per Disney+ subscriber, as more customers subscribed through a discounted bundle with the Company’s other services,” the complaint said. “Notably, the bundled offering made up about 40% of domestic subscribers, confirming that Disney was relying on short-term promotional efforts to boost subscriber growth while impairing the platform’s long-term profitability.”

Despite those headwinds, Chapek decided to “go all in” on the platform, announcing a major reorganization of the company’s media and entertainment operations, the suit said, alleging the move was a “dramatic departure from Disney’s historical reporting structure and was hugely controversial within the company because it took power away from creative content-focused executives and centralized it in a new reporting group” led by Daniel.

The suit pointed out that Iger, whose contract was extended through 2026, unraveled much of his predecessor’s decisions after returning for a second stint to run the company.

The complaint concludes that Disney’s “wrongful acts and omissions” led to the “precipitous decline in the market value” of the company’s shares.

Disney did not immediately return requests for comment.

Earlier this month, Iger reported that Disney+ lost 146.1 million subscribers during the most recent quarter, a 7.4% decline from the previous quarter.

The company has taken a $3.7 billion hit over the past 12 months ending June 30 from its streaming services, which include Disney+, ESPN+ and Hulu, Forbes reported.