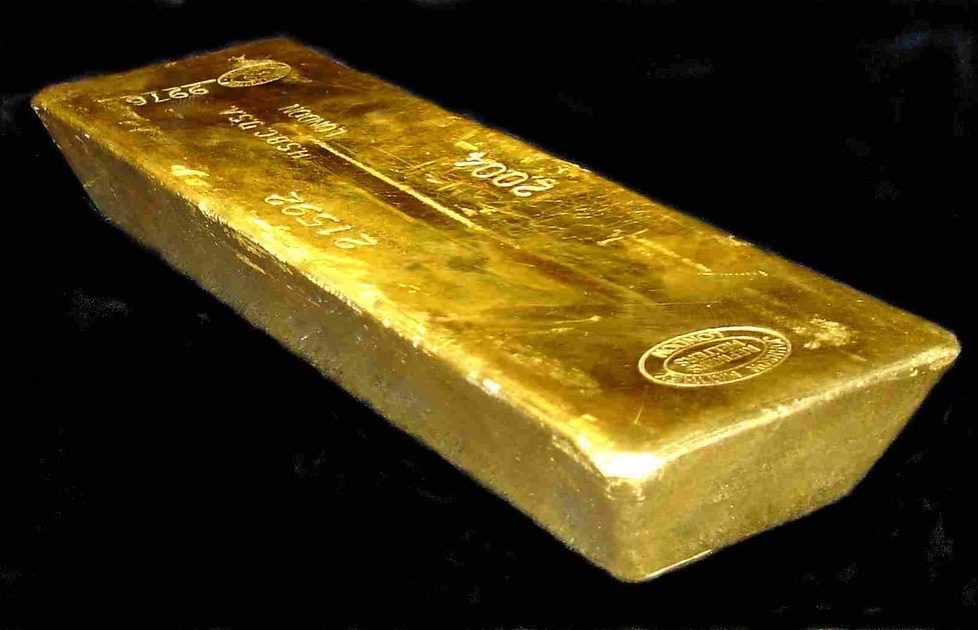

Gold All-Time High. The rise of spot and futures gold prices.

Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, we look at the rise of spot and futures gold prices. (See the Precious Metals section.)

Gold continues to roar! After hitting an intraday all-time high of $2,119.50 USD per Troy ounce on Sunday night (December 4th, 2023) — which was Monday morning, in Asia — gold settled down in the $2,020/oz. range. That is still quite high. For the record, I am still quite bullish on gold, and I’m confident that silver, platinum, and palladium will all soon bounce back to catch up. It is also noteworthy that Bitcoin is moving up in unison with gold. When I checked on Friday morning, it cost $43,920 USD to buy 1 BTC, and Ethereum was at $2,374!

o o o

From Kelsey’s Gold Facts: Gold Price, Inflation, Dollar Collapse, & BRICS.

o o o

Over at Seeking Alpha: Gold Price Spikes To All-Time High To Start December.

o o o

And at Gold-Eagle.com: Andy Schectman, Lee Freeman: Sunday Gold Spike The Result Of Shift To Gold Over Treasuries.

Chinese Wealth Giant Crumbles: ZEG’s Insolvency Shakes Shadow Banking. JWRs’ Comments: Beware. If the Mainland China banking collapse continues, then we can expect to see contagion worldwide in the credit derivatives markets.

o o o

Rail union says Union Pacific layoffs of over 1,000 track maintenance workers jeopardizes safety.

o o o

And speaking of The Oracle of Omaha: Warren Buffett may help Occidental Petroleum pay for a potential $10 billion takeover. Here’s what’s fueling the speculation.

o o o

“Spiraling Out Of Control”: The U.S. Debt Crisis Goes Parabolic.

Reader C.B. spotted this WSJ article: The World’s Key Canal Is Clogged Up. Winter Fuel Prices Could Get Wacky

o o o

America’s Energy Boom: US Crude Exports Soar To Record High.

o o o

From OilPrice News: Europe’s EV Boom Faces Grid Challenges.

David Haggith: Rumblings in Reserves.

o o o

At FinanceCharts: Overvalued Stocks for Dec. 2023.

o o o

Forbes: 2023 Stock Market Year In Review.

o o o

o o o

JP Morgan predicts “challenging” backdrop for stocks in first half of 2024.

US Dollar Price Action Setups: USD/CAD Tepid After BoC Decision, USD/JPY Wavers.

o o o

Over at The Street: As Bitcoin Price Surges to $42,000 El Salvador President Details Country’s Profits.

o o o

At American Thinker: Saving America Starts with Rejecting Digital Currency.

o o o

From the crypto perma-bulls at CoinDesk: Bitcoin and the Predictability of Crypto Market Cycles.

Property Values in Freefall: Owners Who Struggled to Buy Last Year Have Been Bleeding Money So Far. JWR’s Comments: Prices seem to be holding up well in rural areas. But many major metro areas are showing the first signs of what appears to be an interest rate-driven housing bust.

o o o

Palmetto State Armory (one of our affiliate advertisers) has its “AR-15 Days of Christmas” sale in full swing. Take a look!

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. Thanks!