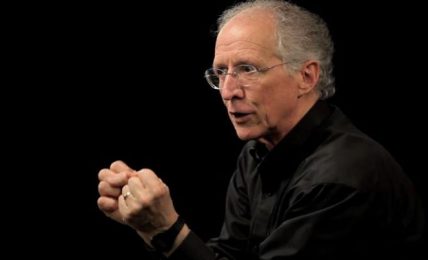

© Lauren Justice/Bloomberg

Gregory Becker, chief executive officer of Silicon Valley Bank, participates in a panel discussion during the Milken Institute Global Conference in Beverly Hills, Calif., May 3, 2022. Becker is expected to testify on Capitol Hill on Tuesday.

The former chief executive of the failed Silicon Valley Bank plans to tell Congress on Tuesday that no bank could have survived its unprecedented deposit flight, which led to its closure by federal regulators and raised questions about the health of the U.S. financial system.

Gregory Becker, who was ousted as CEO two days after the bank collapsed, also plans to tell the Senate Banking Committee that he took “seriously” warnings from federal regulators that the bank needed to improve its internal management and controls. And he will defend SVB’s top executives against charges of incompetence.

“The leadership team and I made the best decisions we could with the facts, forecasts, and outside expert advice available to us at the time,” Becker plans to say, according to a copy of his written statement posted on the committee’s website.

If U.S. defaults on debts, this company has two months of payroll saved up

His testimony comes less than three weeks after a Federal Reserve review of the bank’s collapse castigated its board and executive team for failing “to manage their risks.”

In early March, after what Becker’s written statement calls “rumors and misconceptions” about SVB’s health spread online, the bank lost $42 billion in deposits in a single day. Customers requested withdrawals of an additional $100 billion for the next day, which proved to be the bank’s last.

Over those two days, the bank suffered $142 billion in actual and requested withdrawals — a multiple of the previous largest bank run in U.S. history, which saw $19 billion leave Washington Mutual over 16 days in 2008, according to Becker’s testimony.

“I do not believe that any bank could survive a bank run of that velocity and magnitude,” he is expected to say.

Becker links the bank’s failure to government spending and Federal Reserve interest rate decisions. Government stimulus in response to the coronavirus pandemic pumped nearly $5 trillion in new deposits into commercial banks while the Fed’s near-zero interest rates left SVB with few options to deploy the new funds other than to invest them in low-rate government securities, according to his statement.

The bank grew to $212 billion in assets by the end of 2021, almost three times what it held two years earlier.

Once SVB topped $100 billion in assets, it drew increased regulatory scrutiny. SVB hired several experienced executives from institutions such as Citigroup and Bank of America to strengthen its risk-assessment team, while conducting a search for a new chief risk officer.

That post remained vacant for much of last year, with the new executive starting work only in December, according to Becker’s testimony.

By the end of last year, SVB had “roughly 1,000 people with all, or the majority, of their responsibilities focused on risk management of some type,” according to Becker’s statement.

During 2020 and 2021, SVB executives were reassured by Fed statements that rising inflation would prove “transitory,” allowing the central bank to keep interest rates low.

Fed says it must strengthen banking rules after SVB’s collapse

When inflation persisted and the Fed began raising rates in March 2022, SVB’s government securities rapidly began losing value. To bolster its fortunes, the bank desperately sought to raise additional capital in its final weeks.

Becker also will defend his annual compensation of nearly $10 million amid complaints from lawmakers in both major parties. In March, President Biden called on Congress to give federal regulators greater authority to recover compensation from executives at failed banks.

At the time, the White House cited reports that Becker had sold more than $2 million in SVB shares about two weeks before it failed.

In his testimony, Becker will say the shares were sold as part of a trading plan set in motion in late January and approved by the bank’s legal team. “I did nothing to accelerate that trade and only learned that it had executed after the fact,” he plans to say.

Becker’s appearance on Capitol Hill on Tuesday will follow the release last month of a Fed review, which identified numerous shortcomings by federal regulators and also had harsh words for SVB’s top executives.

“Silicon Valley Bank (SVB) failed because of a textbook case of mismanagement by the bank. Its senior leadership failed to manage basic interest rate and liquidity risk. Its board of directors failed to oversee senior leadership and hold them accountable,” said the report by Michael Barr, the Fed’s vice chair for supervision.

“I never envisioned myself or SVB being in this situation,” Becker plans to say.

After JPMorgan’s purchase of First Republic, tougher banking regulations loom

Top executives of another failed bank, Signature Bank, also are scheduled to testify on Tuesday and will tell the Senate panel that they think regulators acted prematurely in closing their institution, according to their statements posted on the committee website.

Eric Howell, who became Signature’s president just 11 days before it failed, said the bank was “well-capitalized” and could have survived the sudden deposit outflow that occurred on the same day that regulators shuttered SVB.

The New York-based bank catered to companies involved in the digital assets industry, which was rattled by the November 2022 bankruptcy of cryptocurrency exchange FTX. On March 8, as SVB fought to survive, Silvergate Capital, a crypto-focused bank, announced that it was voluntarily winding down its operations.

“I was confident that Signature Bank could withstand the economic earthquake that occurred on that day,” said Scott Shay, Signature’s chairman. “Although I believed that the bank was in a strong position to weather the storm, regulators evidently saw things differently.”